Last month I went on record that 2021 would be the best year ever for the Toronto real estate market. Just a couple of days later CREA, the Canadian Real Estate Association, made the same prediction. The pandemic hit a year ago. Normally, we look at monthly figures on a year-over-year basis. March 2020 had a split personality in terms of the real estate market. The first two weeks of March 2020 reflected activity normal pre-Covid shutdown and the last two weeks of March 2020 was a much different story, once the shutdown began. This month there were 6,504 sales reported during the first 14 days – up 41% compared to the pre-COVID period last year. In the last two weeks of this month, there were 9,148 sales, an increase of 174% compared to the shutdown period in March 2020. This is a stark reminder of the initial impact COVID-19 had on the housing market and overall economy a year ago. We learned things can change on a dime.

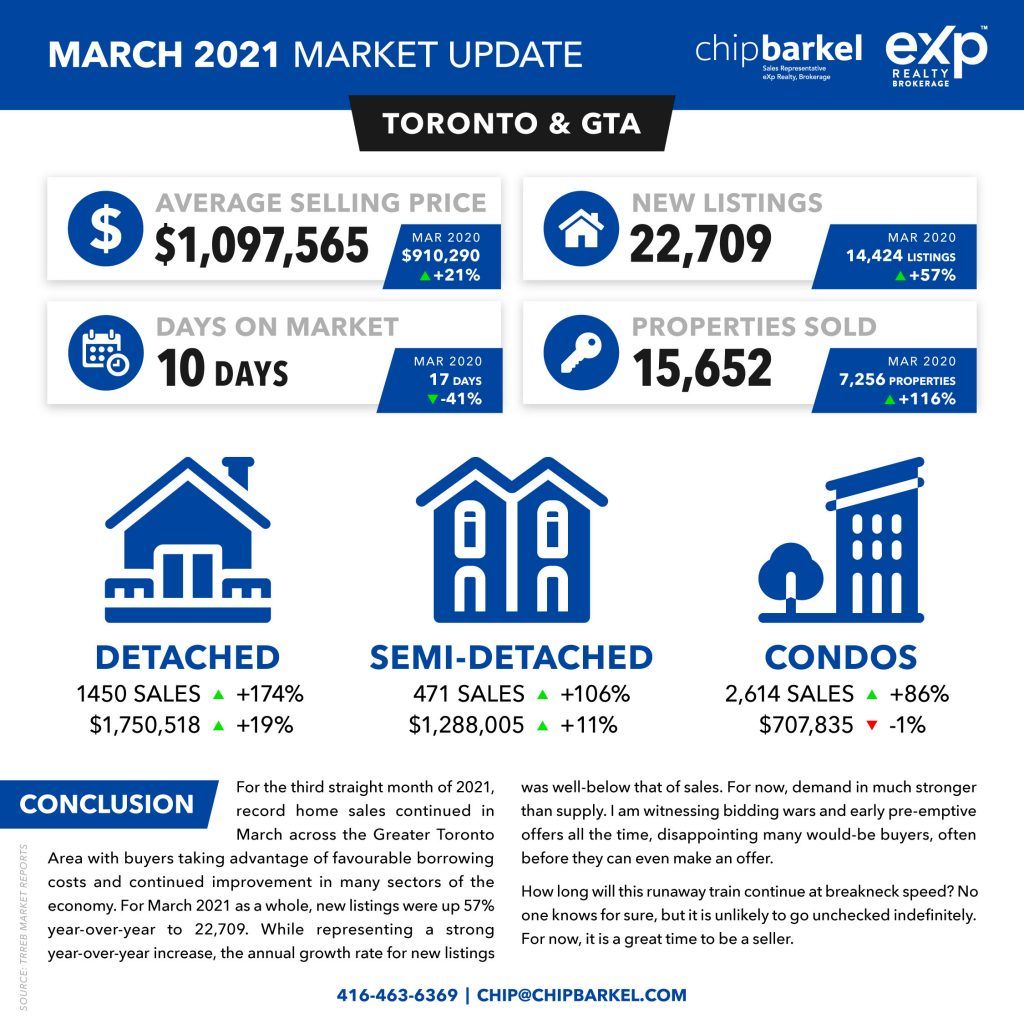

Last month I talked about the fact that the number of properties sold in the Greater Toronto Area in February was just under 11,000 (10,970), a number we hadn’t reached until July of last year. We never even reached that 11,000-property threshold in any month in 2019 and 2018. Well, we have now smashed through that 11,000 number by almost 143% to 15,652.

New listings are up 57% (15,137) and the number of Days on Market (DOM) is down 41% to an unbelievable 10 days. These statistics show that we are in a very strong Sellers’ market, especially considering that Canada’s border is closed to immigration.

Prices were up on a year-over-year basis for all major home types, both in the City of Toronto and surrounding GTA regions, except for condominiums. The numbers for the surrounding 905 regions are even higher than in the City of Toronto, continuing the trend we have seen for many months.

In the City of Toronto, the average sale price came in a bit lower at $1,083,322 which represents a +10% change over last year. Both Halton and York region’s average sale prices were about 16% higher than Toronto, with only Durham region being lower (-16%).

It is also worth noting that the higher end of the market continues to be robust. In March 1,906 properties having a sale price of $2 million or more were sold, only 45 of which were condominium apartments. By comparison, only 245 properties in this category were reported sold last year (9 were condo apartments), a whopping increase of 677%. When compared to two years ago, the difference is even more striking: a 1,152% increase. This illustrates something we already know; prices are rising dramatically, and confidence remains high across the price spectrum.

In March, condominium apartment sales were up 86%. Despite the fact that the average selling price of condos is down (-1%) year over year ($707,835), buyers are once again embracing condominiums. Bidding wars and pre-emptive offers are the norm.

For now, demand is much stronger than supply. I am witnessing bidding wars and early pre-emptive offers in all housing types, disappointing many would-be buyers, often before they can even see a property or make an offer. How long will this runaway train continue at breakneck speed? No one knows for sure, but it is unlikely to go unchecked indefinitely. For now, it is a great time to be a seller.