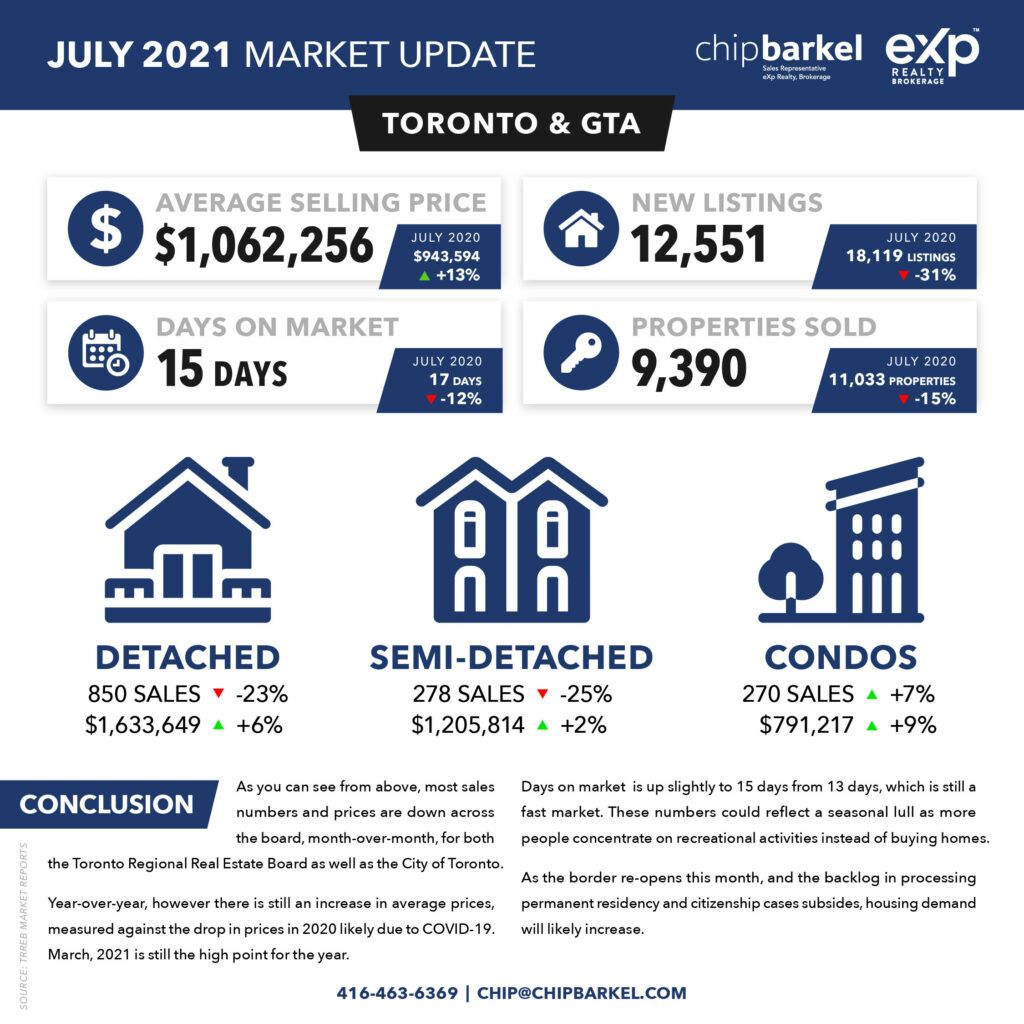

New listings are down about 22% month over month and down 31% when compared to last year, which means inventory is still a problem. The Days on Market (DOM) is still a very low 15 days, but the average selling price is up 3% since last month and 13% over a year ago.

Most of these numbers reflect a late fall or early winter pattern (November – January) instead of mid-summer. This could be the summer lull we have not experienced in a few years.

In the City of Toronto, the average selling price came in flat at $1,016,580 over 2020 and about 6% less than last month.

The higher end of the market ($2,000,000+) is up 15% increase in units sold over last year. The decrease of 25% over last month could be echoing the seasonal dip reflected in other price points.

In July, condominium apartment unit sales down dramatically (-86%) over last month, but the average selling price was up 9% over 2020 and 10% over last month.

As you can see from above, most sales numbers and prices are down across the board, month-over-month, for both the Toronto Regional Real Estate Board as well as the City of Toronto. Year-over-year, however there is still an increase in average prices, measured against the drop in prices in 2020 likely due to COVID-19. March 2021 is still the high point for the year. Days on market is up slightly to 15 days from 13 days, which is still a fast market. These numbers probably reflect a seasonal lull as more people concentrate on recreational activities, after months of lockdown and social isolation, instead of buying homes. As the border re-opens this month, and the backlog in processing permanent residency and citizenship cases subsides, housing demand will likely increase.