No matter how you look at the numbers from November: average sale price, supply, months of inventory, days on market, they all tell the same story: we are in a very fast, very competitive sellers’ market with the lowest inventory we have seen in years. Days on market is only 13, which considering many homes wait a week before accepting offers, shows this is a swift market, indeed.

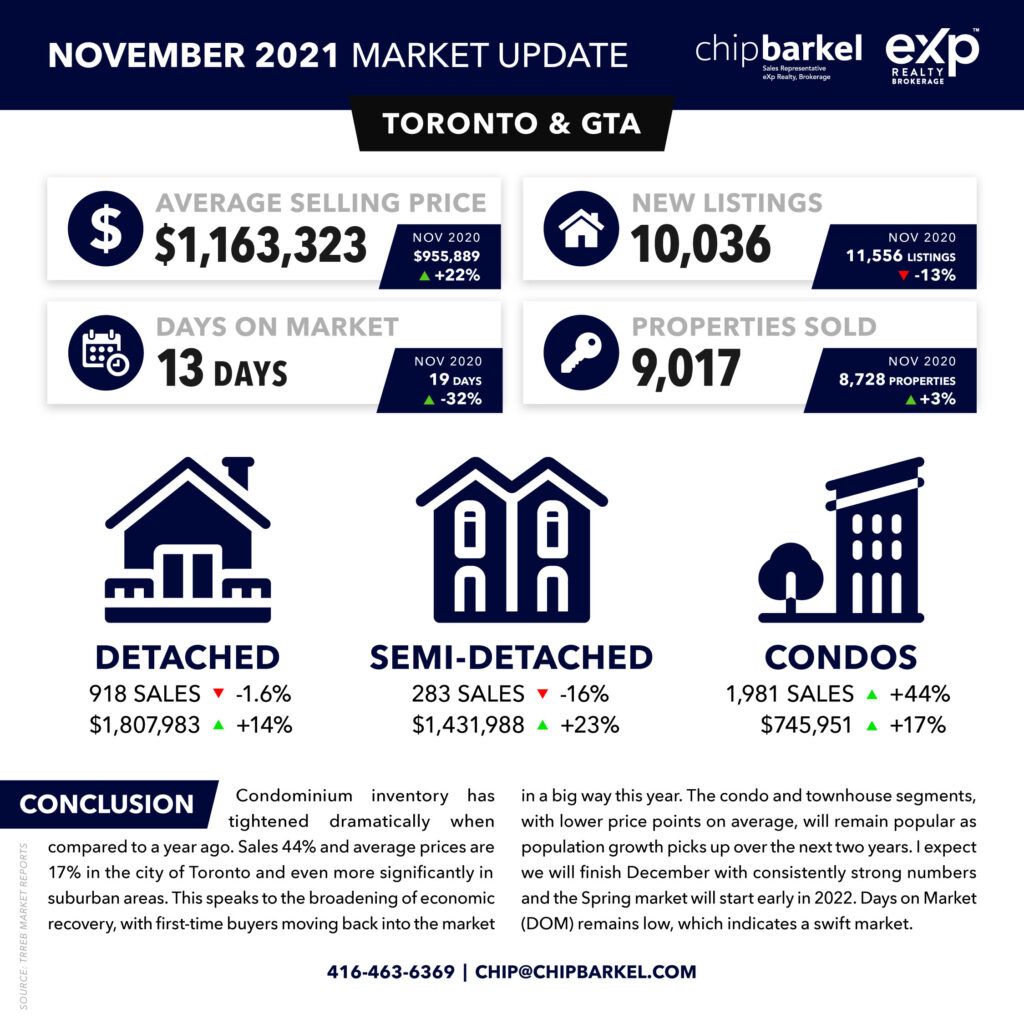

We have heard low inventory and increase in sales prices before, but it can’t be taken for granted. New listings are down (-13%), properties sold are UP (3%), days on market are down (-32%), BUT average selling price is UP 22% across the Toronto Regional Real Estate Board (TRREB). The fact that the properties sold number is up 3% rather than down points to an unusually robust market for November, a month that is normally heading towards a seasonal slumber.

In the City of Toronto, the average selling price came in 12% higher at $1,096,736 over 2020.

The higher end of the market ($2,000,000+) saw a whopping 96% increase in units sold over last year, and a -7% seasonal dip over last month. The increase at this level is probably a result of continued low-interest rates as well as confidence going forward that Covid-19 is being managed.

Condominium apartment unit sales were up (44%) over last month and up (4%) over last month. The average selling price was also up 1% last month, but up 17% over last year.

November 2021’s supply is EXTREMELY low. We had only 6,000 homes available for purchase. That includes all types of housing stock. Keep in mind this 6,000 number includes almost 3,000 condominium apartments, which means that across all of TRREB we have about 3,000 houses available for sale. This is the lowest amount of supply going back years. That means average sale prices go up because demand remains strong. This supply issue is not just a Toronto problem, it is pervasive across neighbouring regions York, Durham, Peel, and Halton where most jurisdictions have less than one month of inventory available for sale. We are on track to end the year with 120,000-122,000 properties sold, a new record.

No doubt some sellers are moving their purchase timeline up with the belief that interest rates will rise in the new year. This has added to the demand we are seeing. The bottom line is this: If you have a house or condominium to sell, the first part of 2022 is an optimum time to sell.